All about Digital Banking 2020 - Events - American Banker

Digital financial becomes part of the broader context for the relocate to online banking, where financial services are supplied over the web. The change from conventional to digital banking has been progressive and continues to be continuous, as well as is comprised by varying degrees of financial solution digitization. Digital banking includes high levels of process automation as well as online services and also may consist of APIs allowing cross-institutional solution composition to deliver financial items and give transactions. website technologies.

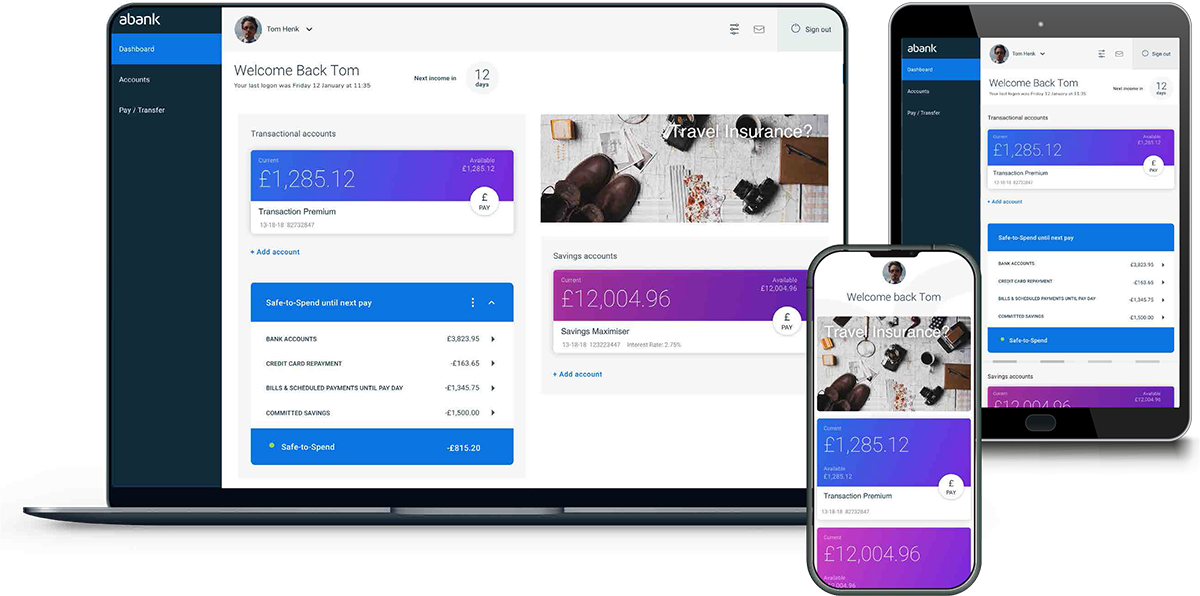

A digital bank stands for a digital procedure that consists of on the internet banking and past. As an end-to-end system, digital banking must encompass the front end that consumers see, the backside that lenders translucent their web servers as well as admin control panels and also the middleware that attaches these nodes - bxp. Eventually, an Additional resources electronic financial institution needs to facilitate all functional degrees of financial on all solution shipment platforms.

The reason electronic banking is even more than just a mobile or online system is that it includes middleware options. Middleware is software that bridges operating systems or data sources with other applications. Financial market departments such as danger monitoring, product development and also advertising and marketing have to likewise be consisted of in the center as well as backside to genuinely be considered a total electronic financial institution.

The Ultimate Guide To Digital Banking - Wikipedia

The earliest kinds of digital financial trace back to the arrival of ATMs as well as cards released in the 1960s. As the net emerged in the 1980s with very early broadband, electronic networks started to link sellers with providers and also customers to develop requirements for early on the internet catalogues and also inventory software program systems.

The enhancement of broadband and ecommerce systems in the early 2000s brought about what appeared like the modern electronic banking globe today. The proliferation of mobile phones through the next decade opened the door for transactions on the move past ATM makers. Over 60% of consumers now utilize their mobile phones as the recommended technique for electronic financial.

This vibrant shapes the basis of client satisfaction, which can be supported with Customer Connection Monitoring (CRM) software application. As a result, CRM has to be incorporated right into a digital financial system, considering that it supplies methods for banks to straight communicate with their clients. There is a need for end-to-end uniformity and for solutions, maximized on convenience and user experience.

9 Easy Facts About Crowe Brandvoice: The Future Of Digital Banking - Forbes Described

In order for banks to fulfill consumer needs, they need to maintain concentrating on boosting digital technology that provides agility, scalability as well as performance. A research study carried out in 2015 exposed that 47% of bankers see possible to enhance consumer partnership through digital banking, 44% see it as a way to generate affordable advantage, 32% as a network for new client acquisition.

Significant benefits of digital financial are: Service effectiveness - Not only do digital platforms enhance interaction with consumers as well as deliver their needs extra quickly, they likewise offer techniques for making inner functions much more efficient. While banks have gone to the forefront of digital innovation at the customer end for years, they have not totally embraced all the benefits of middleware to speed up performance.

Standard bank processing is pricey, slow and also vulnerable to human error, according to McKinsey & Firm. Counting on individuals and also paper likewise takes up workplace, which runs up power as well as storage costs. Digital systems can future https://www.washingtonpost.com/newssearch/?query=digital banking lower costs via the harmonies of more qualitative information and also faster response to market changes.

All about Digital Banking - Pymnts.com

Paired with lack of IT assimilation in between branch and back workplace workers, this issue lowers organization effectiveness. By simplifying the confirmation procedure, it's easier to apply IT services with service software, leading to more exact accounting. Financial accuracy is essential for financial institutions to adhere to government laws. Boosted competition - Digital services aid handle advertising and marketing listings, permitting financial institutions to get to broader markets and also build closer connections with tech smart consumers.

It works for carrying out consumer benefits programs that can boost commitment and also contentment. Greater dexterity - The use of automation can accelerate both exterior and internal processes, both of which can improve consumer fulfillment - newcastle permanent online banking log on. Complying with the collapse of monetary markets in 2008, an increased focus was put on threat administration.

Boosted safety - All organizations huge or small face a growing number of cyber dangers that can harm reputations. In February 2016 the Internal Earnings Solution revealed it had actually been hacked the previous year, as did several large tech firms. Banks can gain from extra layers of safety to shield information.

Getting The Digital Banking 2020 - Events - American Banker To Work

By changing hands-on back-office procedures with automated software application remedies, banks can minimize worker errors and also speed up procedures. This paradigm shift can lead to smaller operational systems and also permit managers to concentrate on enhancing jobs that require human treatment. Automation decreases the need for paper, which certainly winds up occupying room that can be inhabited with innovation.

One means a bank can improve its backside business effectiveness is to divide numerous processes into 3 classifications: full automated partially automated hands-on tasks It still isn't functional to automate all operations for many economic firms, specifically those that perform financial reviews or offer financial investment suggestions. However the even more a bank can change difficult repetitive manual tasks with automation, the more it can concentrate on issues that entail direct communication with customers.

Furthermore, digital cash money can be mapped as well as accounted for more precisely in situations of conflicts. As customers find a boosting number of purchasing possibilities at their fingertips, there is much less requirement to bring physical money in their pocketbooks. Other signs that demand for digital money is growing are highlighted by the use peer-to-peer settlement systems such as PayPal as well as the increase of untraceable cryptocurrencies such as bitcoin.

4 Easy Facts About Digital Banking - Wikipedia Explained

The trouble is this innovation is still not omnipresent. Cash money blood circulation grew in the USA by 42% in between 2007 and 2012, with a typical annual growth rate of 7%, according to the BBC. The concept of an all electronic cash money economic situation is no more just an advanced dream but it's still unlikely to obsolete physical money in the future.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA